|

A Solar Power System is a Great Financial Investment

In years past, a solar power system you purchased for your residence or business would take 25+ years to pay itself off. This is not the case today. With all the financial incentives now available, such as tax credits, state incentives, and local utility incentives, a photovoltaic system typically has a payback time of 5-10 years! Sometimes sooner! All of the rebates and incentives can end up paying for more than 50% of your system cost! That is incredible!

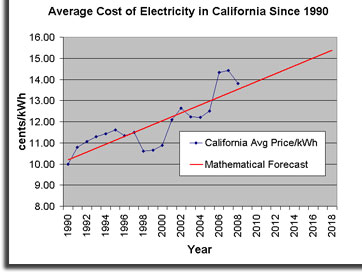

As you will notice on the graph above, the average price of electricity in California has increased by an average of 6% per year. The red line is a mathematical prediction of where the cost of electricity is headed over the next decade. Investing in a solar power system today, will keep you from experiencing these increases. This also means your return will increase each year as the cost of electricity from the utility continues to rise.

The return on investment (ROI) from a photovoltaic system is typically 10-15% per year, depending on the incentives you receive in your area. This means if for example you spend $10,000 on your system, you will receive anywhere from $1000 to $1500 per year from your investment. This money is received in the form of savings on your electric bill. So that is like earning another $1000 from your job every year, which goes right into your pocket. Also keep in mind, that this financial gain is TAX FREE!

Why Not Invest This Money in the Stock Market Instead?

Simple. The risk of investing in a photovoltaic system is very small compared to the huge risk of the stock market. Think of it this way, you can earn the same amount on good years in a mutual fund with tons of downside risk, or earn the same amount consistently with virtually no downside risk with a solar system.

Ask yourself this, "how do I cash in on my return from a mutual fund vs. a solar system?" In order to cash in on the return from a mutual fund or stock, you must sell some shares. You will eventually run out of shares and therefore no longer have that investment. With a solar power system, your return is given to you every month by not having to pay for the electricity that your going to use either way. This will continue to give you a return for the life of the solar system, which in most cases exceeds the 25 year warranty typically placed on them.

Also remember, that if you were to sell shares of a stock or a mutual fund, you would have to pay taxes on your capital gains. The return you receive from your solar investment is not taxed! So for example, lets say the gains tax is 15%, and your return for the year is $1000. This means you would pay $150 in taxes for the money you made by selling some stock or mutual funds, however, with a solar system, you would pay nothing!

Best Return on Investment (ROI) vs. 100% Elimination of Electricity Bill

The environmentally responsible thing would be to completely offset 100% of your electricity usage with solar power. This is the ideal case since you are not only making a great financial investment, but also maximizing the benefit to the environment. However, depending on how your local utility company charges for electricity, 100% offset may not give you the absolute maximum return on investment. Most utilities charge you for electricity based on a "Tier" schedule. Let's use Southern California Edison (SCE) as an example. SCE uses 5 Tiers to determine your rate. The bottom tier is known as "baseline" usage, which is defined by SCE as the amount of power an average home should use in a given area. These rates are dependent on the season, summer or winter, as well. Once you use more power than allotted in the baseline tier, you then move into tier 2, which costs you more money per kilo-watt-hour (kWh). This trend continues all the way up to Tier 5, increasing in per kWh cost each Tier. As an example, the early 2010 winter time Tier schedule for SCE is shown here:

Tier 1 (baseline) |

Tier 2 |

Tier 3 |

Tier 4 |

Tier 5 |

|

|---|---|---|---|---|---|

| Cost/kWh | $0.12 |

$0.14 |

$0.23 |

$0.27 |

$0.30 |

| kWh/Tier | 296 kWh |

89 kWh |

207 kWh |

296 kWh |

N/A |

The best return on investment comes when you eliminate the top three tiers since they are the most expensive. In other words, you size your photovoltaic system so that you never use more than 385kWh (Tier one + Tier two, which is 296kWh + 89kWh = 385kWh) each month from the utility company, and the rest is provided by your solar power system. Have no fear, the solar contractor will do all these calculations for you based on your previous 12 months of power usage.

What about a Retiree on a Fixed Income?

If I just retired or are within a couple years of retiring, should I spend some of my fixed retirement money on a solar power system? Yes! A paper presented at the IEEE Photovoltaic Specialists Conference in 2008 showed a tremendous cost benefit for retirees investing in a solar system as opposed to using the same money in a mutual fund. Remember, as mentioned previously, a solar power system gives a TAX FREE return, and mutual funds do not!

See how a solar system increases your property value without increasing your property tax!